July 8, 2019

by David Goodale

As CEO of Merchant-Accounts.ca, I've worked for 25 years to promote merchant education. Multi-currency payments are one of the least understood facets of payment processing.

If your business collects payments in foreign currencies and you are looking to expand your knowledge you've come to the right place. Before moving to the discussion I'll point out that we provide multi-currency processing services, but this is not a sales oriented article. It's a deep analysis of how to deploy a multi-currency e-commerce website. If you're just looking for a multi-currency processor for your business head on over to our multi-currency processing page.

The ultimate multi-currency processing whitepaper

In this article we'll take a deep dive into the world of multi-currency payments, starting with an overview of how it works, how to set it up, the costs involved, interchange, cross border fees, settlement currencies, FX considerations, issues to be aware of, popular multi-currency processing platforms, as well as technical and integration requirements.

Be warned that this is a detailed read, and not for the faint of heart. However, if you take the time to work through it you'll find all the information needed to implement a multi-currency solution. If you find this overwhelming and would rather have us help you with your questions, simply reach out and contact us.

Need professional guidance?

Contact us for a free one hour consultation.

Index

- What is Multi-Currency Processing?

- Does your business actually need multi-currency payment processing?

- What are the facts? How will multi-currency processing help a business to capture more sales?

- How to setup multi-currency processing

- Negotiating rates and application considerations

- Technical considerations: e-commerce, online invoice payments or virtual terminal?

- Integration considerations: how do I setup my website to accept payments in multiple currencies?

- How to set prices in foreign currencies: hard coded or dynamic currency pricing?

- What to know about settlement currencies

- Limitations in different acquiring regions (limited settlement currencies in the USA and Canada)

- Base currency settlement: receiving your funds into a single base currency

- Like-to-like settlement: receiving funds in foreign currencies

- Basing your business in Europe to get access to more settlement currencies

- Understanding FX fees incurred upon settlement

- Using a currency brokerage to reduce FX conversion costs

- Estimated cost savings of like-to-like processing

- Additional cost considerations: cross border fees incurred by merchants

- Potential customer complaints: be aware of international transaction fees to cardholders

- Popular multi-currency shopping cart software

- Popular multi-currency capable payment processors

- Most popular online payment currencies

- Multi-currency research: getting to know your prospective customers

- Summary

What is Multi-Currency Processing?

Multi-currency payment processing occurs when your business can accept credit cards from customers in foreign currencies. If your business charges customers in more than one currency (for example in US dollars and Canadian dollars) you are doing multi-currency processing.

Multi-currency processing can involve a complex setup of many different billing currencies. For example, you might charge customers in USD, CAD, GBP, EUR, ZAR, AUD and NZD, which would allow you to target customers in all major English speaking countries.

Does your business actually need multi-currency payment processing?

Visa and Mastercard ensure that cards can be used anywhere in the world, easily and without hassle for the cardholder. Even if you don't cater to foreign customers they can still easily complete a purchase. Their card issuing bank will see that it's a foreign transaction and will handle all the exchange rate concerns. It just automatically works... so technically speaking, you don't need to bill foreign customers in their own currency. However, your business won't be very effective if you don't.

Consumers are increasingly sophisticated and have many options to choose from. If you want to achieve success in foreign markets, you must cater to your foreign customers as a priority and not as an afterthought. It's not just about providing simple familiarity because you want to encourage sales, it also reduces disputes and chargebacks that sometimes occur as a result of pricing discrepancies when credits are issued.

What are the facts? How will multi-currency processing help a business?

The benefits of multi-currency processing can be broken down into the following categories:

- Marketing reasons (make more sales)

- Administrative reasons (reduce customer complaints)

- Commercial reasons (lower costs)

We'll look at each one on it's own merit.

-

Marketing Reasons:

In order to convert a prospect into to a paid customer you must build trust, remove fears or concerns your prospective customer has, and offer a compelling reason to proceed with the order.

Converting prospects to sales represents a gauntlet of challenges that extend beyond just currency concerns, but it's easy to identify that a lack of local currency support will immediately cause a number of issues. The first and obvious issue is that the customer may not be conveniently familiar with the exchange value of the advertised currency.

For a moment, pretend you are a prospective customer. In this example we'll say you are purchasing from an online business based in New Zealand, selling in New Zealand dollars. Are you able to immediately quote (no looking it up) the exchange rate for 100 NZD (New Zealand Dollars) into your local currency? Unless you live or travel to New Zealand frequently, or trade FX frequently, you won't know the answer. It's blatant and obtrusive: this business is not catering to you. (Not to pick on New Zealand which is a beautiful country - heck they filmed Lord of the Rings there!)

Currency familiarity is easy to be dismissive of, and a seemingly small concern. "They could easily open a browser tab and look up the exchange rate, so what's the big deal?". It sounds like much ado about nothing, until you stop to think about it.

First, accept that customers are lazy. Yes, some will take the effort, and probably a majority (especially if they really want what you are offering), but some won't. Further though, while a prospective customer could look up the exchange rate, they'll still have no way to know how much will actually be charged to their credit card. The card issuer will take the mid-market rate and mark it up with an extra currency conversion fee. There is no way for them to actually know how much will be charged upon completing the order.

Much more importantly - and almost subconsciously - how much more comfortable are you when you see a price displayed in your local currency? Maybe you aren't any more comfortable at all, because it's what you are expecting. Just the act of seeing pricing in your local currency sets an undertone for catering to you as a customer. Although it may not have explicitly helped in any way, no alarm bells went off because you saw what you expected to see. The business has prevented a potential fear or concern from forming, and the website will also appear more sophisticated and trustworthy. Without any conscious effort or thought the customer will have more confidence proceeding with the order than if they had seen prices in a foreign currency. Friction, unease and concern are the hallmarks of a poorly designed checkout funnel. You should be striving to avoid this in any way possible.

Finally, we should think more about friction, customer laziness and competitors. Incorporate into your line of thought the fact that some of your competitors will be targeting these same potential customers. If you are both targeting foreign customers, but one makes the customer feel more confident and at ease, then who will be better positioned to make the sale? Your business does not (or likely does not) operate in a vacuum, and if your competitors offer local billing but you don't, then you are at a disadvantage.

-

Administrative Advantage:

Currently related administrative challenges are unique to each business. There are many different use cases in which multi-currency processing can be administratively advantageous. For example, your business might incur costs from suppliers in foreign currencies. If you have costs in foreign currencies, but charge and receive funds in your local currency, it introduces FX risk into your business (ie: you may not be able to maintain profit margin during currency volatility). Some of the administrative challenges are too specific to work into this discussion, but if you think about your business you can probably envision ways that separating out currencies will offer advantages. In some cases it's not mission critical, but could be as simple as a business owner that likes to travel and so maintains funds in foreign currencies for convenience.

There are some administrative advantages that are universal. One of them involves the handling of refunds and chargebacks. Pretend for a moment you make a $1,000 USD sale to a customer. The cardholder in this example is Australian. Their card issuer takes the $1,000 USD, determines the appropriate exchange rate (into AUD) and charges their credit card. A month passes by and a refund needs to be given to the customer. This could be because of a product return, or a customer service issue. It doesn't really matter why, for the purpose of this example we just need to make clear that a refund needs to happen.

The customer should get all their money back, and no problems, right? Wrong. If the exchange rate for the Australian dollar has moved in the wrong direction, even though you fully refund $1,000 USD to the card, the cardholder may still come up short.

In this situation the responsibility should be with the cardholder, and the issuing agreement between the cardholder and issuing bank likely states this. However, customers aren't always informed, or even reasonable. They might be really upset. They might try to charge it back. They might attack your business online by leaving negative comments. For right or for wrong, you have a potential dispute on your hand, an unhappy customer, and unnecessary headaches. A very clean and simple way to eliminate this possibility is to bill the cardholder in their local currency (in this example in AUD), which would have allowed you to push the proper amount bank to their card, and would have prevented the problem from occurring.

Having the ability to process in (and hold) foreign currencies provides strategic advantages that are unique to each business. You need to explore them to best determine how it can best be used to your advantage. If you have questions about this reach out to us for help.

-

Commercial Advantage:

There are huge, HUGE potential cost advantages with multi-currency processing. This is especially true if you've implemented payment processing with like-to-like settlement, which is something we will explore in further detail below.

To reiterate in an explicitly clear manner: an ideally deployed multi-currency processing solution can save many thousands of dollars in processing costs. Interchange optimization is something we'll explore later in this article. It's possible to easily achieve a 1% cost savings simply by eliminating cross border fees. The savings are multiplied if you add like-to-like settlement of foreign multi-currency transactions.

Sometimes the cost savings can be much more, with the potential to be as much as 5% in some circumstances. This can be achieved once you factor in cross border fees charged to merchants, FX fees from multi-currency transactions that are incurred upon settlement into a base currency, and savings earned through reduced interchange costs from getting domestic acquiring in a foreign country. These cost savings opportunities are explored in further detail below. If you optimize every aspect of your payments infrastructure the savings can be genuinely tremendous.

It must be stated that this cost efficiency is not always easy to achieve because the most optimized level of savings often require a fairly sophisticated corporate structure. For it to make sense you need to process enough foreign sales to be worth it. In general, if you are processing at least $50,000 per month in foreign sales it starts to be worth having a discussion about. If you are processing at least $100,000 per month in sales it starts to provide a clear cost advantage. If you process significantly more than $100,000 in foreign markets but haven't optimized your payments infrastructure, you could be making a costly mistake. Some businesses process millions per month in foreign currencies, but with minimal efforts towards cost optimizations. This can literally mean hundreds of thousands of dollars of potential savings that are not capitalized upon. This is money that you are giving away, and could otherwise retain, had you structured your business differently.

Interchange optimization (for international payments) is exactly what we specialize in at Merchant-Accounts.ca. It's why we've built a diverse network of strategic bank and processing platform partners. No single or individual bank or platform is the best fit for every business, in every currency, in every country. We'll explore this in further detail below.

How to setup multi-currency processing.

In this section we'll explore some of the initial considerations to keep in mind when implementing multi-currency processing for your business.

It's obvious that you'll need to work with a multi-currency payment processor. Simply getting an account can be easy, but setting it setup in an optimal way is not. There are many acquiring banks and processors to choose from. The following criteria must be considered:

- The location of your own business

- Desired processing currencies

- Desired settlement currencies

- The location of your customers

- The required payment types in each of the countries that your customers are located in.

It must be reiterated that the success of your project, to a very significant degree, is determined by making the right choices early on in the process. You likely won't just fall onto the right platform. It's not just about ticking boxes from a laundry list of features. You need to implement your payment processing structure in a way that:

- Minimizes declined transactions

- Minimizes shopper frustration

- Lowers costs as much as possible

- Addresses commercial concerns (such as FX fees and holding of foreign currencies).

This may seem overwhelming, but it doesn't have to be. To begin with, we should acknowledge why a network of platforms is always ultimately more capable than any single platform.

An inescapable fact that most payment processors will not admit:

There is no singular acquiring bank, gateway or processing platform that is the best fit for every business, in every country, in every currency.

When you contact a payment processor they must sell you strengths of their solution. If you were to call Pepsi and ask about their product they'd be unlikely to tell you that Coke has less sugar per serving. In other words, payment processors will only extol their own virtues, but what if no singular solution is the best fit for every merchant in every country?

It should be plainly obvious that no single payment processor can be the best at everything. That's why when working with our clients, we break down the needs in a granular way to find the solution, or network of different solutions, banks and platforms, to provide what is genuinely the best fit for that business. Our expertise in interchange optimization, settlement currencies and network of bank partners can make this a lot easier, but for those that want to source it on their own we've compiled an overview of the most popular multi-currency processing platforms further below.

Negotiating Rates and Application Considerations

Rates are one of the first and most obvious considerations that must be addressed when beginning the project. The first step of the process will be to negotiate the rates for your merchant account, which is always based on:

- Processing volumes

- Product risk

- Business history

We only recommend interchange plus pricing when getting quotes, and hope you'll contact us to get a rate quote for your project. Regardless of where you go to get a quote, it's important to reiterate that getting a low sounding rate on it's own won't provide the best value because interchange optimization is an important concept to keep in mind. The process of establishing costs should only be done once you understand interchange and acquiring regions. If you don't have this comfort, you won't be able to negotiate or deploy effectively.

Once you have pricing in order and a chosen processor, you'll have to submit an application with your chosen processor. The approval process can be significantly different between processors. Some take from a few days to several weeks for approval, or even (unfortunately) months in some cases depending on the processor you've selected. Other criteria will also play a role in the timing such as the currencies requested, and particularly the product risk associated with your business. If you have a young business, or a business that sells a particularly high risk product or service, review our article about getting approval of your merchant account.

Technical Considerations. E-commerce integration, online invoice payments, or virtual terminal?

Once your merchant account is approved you'll begin the most technically challenging step which is connecting your website to the payment gateway. You'll need to enable checkout in multiple currencies depending on shopper location or customer billing preferences.

In the following sections we'll explore the technical considerations, but before we jump into the full discussion it should be pointed out that multi-currency processing does not obligate you to have a technically burdensome integration.

Some merchants choose a simpler option such as online invoice payments. Another option is to manually process orders with a virtual terminal, which allows you process orders in any currency, using your computer or smartphone. This completely eliminates all of the technical complexity, but as a consequence you lose the automation and marketing opportunities that a true multi-currency e-commerce platform provides. Sometimes it's best to start with a virtual terminal or online invoice payment page, which allows you to begin with almost no effort, and work towards the launch of a multi-currency e-commerce website.

Integration considerations - how to I setup my website to accept payments in multiple currencies?

An e-commerce website must be intelligently configured to bill customers in the correct currency. There are a few different ways to accomplish this, usually based on the following:

Determining which currency is displayed to the shopper:

- Choosing currency based on user IP: When the user arrives on the website the IP address is checked. The country of the IP address will determine what currency is displayed to the shopper. This method is not foolproof because the visitor could be using a proxy service to mask their IP address, or could be travelling and not on their normal IP.

- Choosing currency based on regional website: Some businesses will operate multiple websites, with one specific website for each region. (.com, .ca, .co.uk, etc). In this sense the e-commerce software configuration can be simplified, because it's ultimately a network of single-currency websites. In fact, the IP address check described above could be used to redirect the website visitor to the appropriate regional website, which only requires a single-currency e-commerce platform. All customers directed to that website will see prices quoted in the currency of that region. (This allows you to have a multi-currency capable e-commerce website, without a multi-currency capable shopping cart).

-

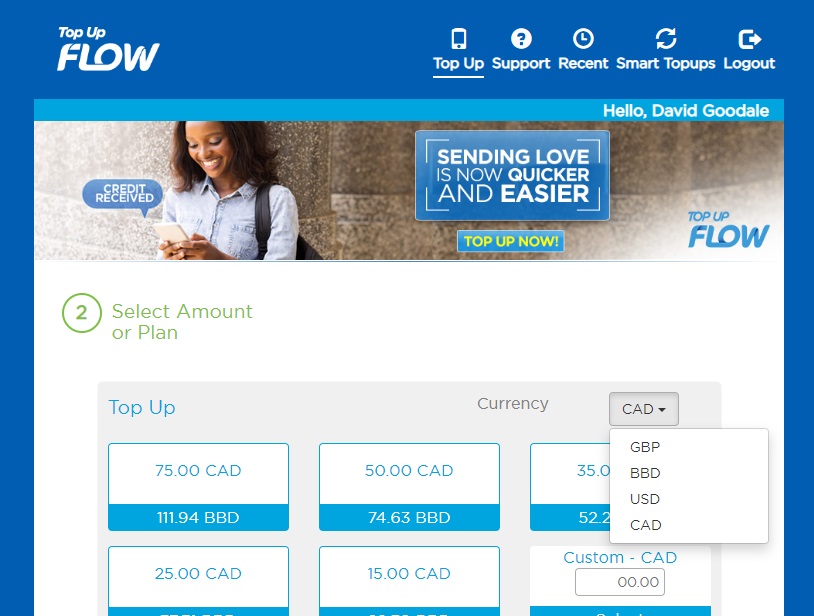

Choosing currency based on user choice: Another option is to allow the user to select their billing currency through some sort of user interface choice. This will require a multi-currency capable shopping cart software. For example, you could have a series of flags on the top of the screen, which will set the payment currency that is displayed to the shopper. In the example below, Flow, a provider of mobile phone and data solutions in the Caribbean allows shoppers to choose their top-up currency.

Example of a multi-currency shopping cart that allows the user to select their desired billing currency. Source: https://www.topupflow.com/order

How to set prices in foreign currencies: hard coded or dynamic currency pricing?

Your shopping cart software will need to have a pricing strategy when it comes to displaying prices in foreign currencies. Two different approaches are possible:

-

Dynamic pricing: This is where you have one master currency in your database, with all product prices tied to that master currency. If you were selling beach towels, the master currency price of a beach towel might be $20 USD. If a shopper from Canada were to visit your store, the system would look up the current exchange rate to convert $20 USD into CAD. It would complete the calculation and display the appropriate price in Canadian dollars. The main advantages of this approach are that it protects you against currency drift over time as exchanges rates fluctuate, is very easy to maintain, and protects your margins because the rate is constantly being updated in real time as each order comes in. This is the most popular method, is good for big catalogs, but possibly not the best for service based businesses that bill hourly, or for businesses with small numbers of items that want control over how the price is displayed to the shopper.

Dynamic pricing: This is where you have one master currency in your database, with all product prices tied to that master currency. If you were selling beach towels, the master currency price of a beach towel might be $20 USD. If a shopper from Canada were to visit your store, the system would look up the current exchange rate to convert $20 USD into CAD. It would complete the calculation and display the appropriate price in Canadian dollars. The main advantages of this approach are that it protects you against currency drift over time as exchanges rates fluctuate, is very easy to maintain, and protects your margins because the rate is constantly being updated in real time as each order comes in. This is the most popular method, is good for big catalogs, but possibly not the best for service based businesses that bill hourly, or for businesses with small numbers of items that want control over how the price is displayed to the shopper.

- Multiple prices for each product: The other option is to set a price for each specific currency. For example that same bath towel in the example above might be hard coded to $20 USD, $25 CAD, $27 AUD. The benefit to this is that you can set clear pricing breakpoints with control over exactly what price is displayed to the shopper. The downside is that as exchange rates fluctuate the product prices will become out of sync with each other. The same item will cost more in one currency and less in another as they drift out of sync. Setting prices directly in each currency is best for very small catalogs where you want to set pricing breakpoints (ie: you want it to specifically say $29.99), and for service based businesses.

What to know about settlement currencies when it comes to multi-currency processing.

Collecting payments in foreign currencies is only half of the equation. You've collected a payment, but how do you receive the money? Or more specifically, in what currency do you receive the money? Don't answer this question too quickly, because there is more to it than may appear.

When you receive your money, it's called "settlement" or "funding" depending on the processor. In the next few paragraphs we'll explore the settlement options for funding into your business bank account.

Limitations in different acquiring regions (limited settlement currencies in the USA and Canada)

One of the first things that you'll find when researching your options, is that the settlement currencies available to Canadian and US based merchants are very different than for European merchants.

In comparison to North America, European acquirers generally have access to a broader range of settlement currencies.

This means that it's usually easier for merchants with a business presence in Europe to avoid currency conversion when doing multi-currency processing. In Canada or the USA, you can bill cardholders in just about any conceivable currency, but settlement is usually limited to USD or CAD. This seems to be a limitation from either Visa, Mastercard or the collective acquirers in Canada and the USA (uncertain and will update if I get an authoritative answer on this topic), whereas in Europe the following settlement currencies are readily available:

| United States Dollar | USD | Canadian Dollar | CAD |

| Euro Dollar | EUR | United Kingdom Pound | GBP |

| Australian Dollar | AUD | New Zealand Dollar | NZD |

| South Africa Rand | ZAR | Hong Kong Dollar | HKD |

| Japan Yen | JPY | Switzerland Franc | CHF |

| Denmark Krone | DKK | Norway Krone | NOK |

| Sweden Krona | SEK | ||

By supporting the above currencies it provides coverage for the leading major industrialized nations and reach into most developed e-commerce markets.

Many of our clients contact us about establishing payment processing in Europe because they want to get access to the like-to-like settlement currencies. If this is a priority for your business contact us to discuss your project.

Base Currency Settlement: Receiving funds into a single base currency (currency conversion upon settlement)

If you're not willing to setup a business in Europe, or you feel you can't meet the compliance requirements in order to do so, you can still easily implement multi-currency processing. It just means that funds will be converted and settled to you in a single base currency.

In fact, this is by far the easiest way to start accepting multi-currency payments. Your customers will pay directly in their own local currency. After receiving payment from the customer, your payment processor will convert the funds back into your base currency and deposit them into your bank account.

This method is by far the easiest set up. However, it is more expensive than the alternative of like-to-like settlement (discussed further below).

Advantages

- By far the easiest to setup

- Available for merchants in most countries

- Reduced administrative (tax and compliance) considerations

- Can bill in almost any global payment currency.

Disadvantages

- Funds must be converted by the payment processor back into your base currency before sending the funds. The rate a payment processor will charge is more expensive than you would pay through a dedicated FX bank or brokerage account.

- You are not able to hold funds in a foreign currency. If you have expenses in a foreign currency this means you will incur FX fees upon receiving the funds into your bank account, and then must convert funds back into the foreign currency in order to pay your foreign expenses.

One thing to consider (and something I strongly encourage) is that you ask for transparency from your processor in terms of the FX costs that will be incurred upon the conversion into your base currency. It's surprising how many merchants fight tooth and nail over a few basis points on the discount rate, but raise no concerns whatsoever about FX costs that are incurred upon settlement of funds.

In summary, base currency settlement is the easiest and most widely available solution. It's often the better solution because of the ease to implement, but if trading high volumes it's rarely the most cost effective solution. For merchants that process high volumes in foreign currencies we'll explore the alternative below.

Like-to-Like Settlement: Receiving funds in foreign currencies (no currency conversion upon settlement)

If you process in foreign currencies and receive your money directly in those foreign currencies it's called "like-to-like settlement". This method prevents currency conversion from occurring before you receive your funds. Like-to-like processing is one of our core areas of expertise at Merchant-Accounts.ca.

There are a few major benefits to this, the primary of which is that you have total control. You choose if, and when, you want to exchange funds into another currency. (Compared to base currency settlement where you are at the mercy of the exchange rate on the day that you receive your money). Like-to-like settlement completely eliminates this problem, allowing you to hold funds foreign currencies for as long as you'd like.

Timing is not the only benefit however, because you it gives you the ability to convert funds using a FX brokerage or currency conversion provider of your choice. (The exchange rate offered by your local bank is likely not as competitive as a FX brokerage - more on this below).

Controlling the timing of your currency conversions, when combined with choosing a competitive provider for currency conversions, can provide tremendous cost savings. The phrase "tremendously major" is not over emphasizing the potential upside. We are talking about cost savings at a level that is rarely achieved in the field of payment processing. An example is provided further below.

This solution gives you power and control, but it comes with corporate, tax and banking requirements that only make sense if you are processing a relatively high volume of foreign currency transactions. We do quite a bit of consulting in this area so reach out if you want to discuss your project.

Advantages

- Lower costs. Potentially very significant cost savings depending on the amount of foreign currency transactions that you process.

- Allows you to hold funds in foreign currencies

- You can choose when to perform a currency conversion, allowing you to choose a time that is financially beneficial to do so.

- Allows you to pay foreign currency expenses directly from funds held in foreign currencies.

Disadvantages

- Some more exotic payment currencies are not available (or at least are extremely difficult) to find support for like-to-like settlement.

- You will likely need to maintain multiple bank accounts (one for each currency you want to hold funds in).

- Potential tax issues if you don't currently have a business presence in Europe (will probably have to incorporate and file annual returns in a European country).

- Generally more work to maintain the necessary corporate and banking structure.

Basing your business in Europe to get access to more settlement currencies.

As described above, acquiring platforms in Europe often have access to more settlement currencies than are available in North America. It's often a good idea to get a European domiciled merchant account specifically because of the settlement currency options. However, it's worth mentioning that this is a fairly involved project if your business doesn't already have a European business presence. You can't just open an empty shell corporation in Europe and begin processing. In general, empty corporations represent significant chargeback risk to payment processors because they have little assets to go after in the case of losses related to chargebacks. However, even beyond the payment processors risk appetite there are additional requirements from Visa and Mastercard.

The generally accepted rule (which seems to vary between acquirers) is that to get European payment acquiring you must have feet on the ground (employees) with some sort of real world / actual business decisions or activities taking place in Europe. In other words, you can't open a virtual office with no employees, or use a P.O box or some other virtual footprint.

This is sometimes frustrating for merchants because a US or Canadian company could legitimately have European customers, European costs, and want to bill and settle funds in Euros or GBP. It's a very legitimate and real requirement of many businesses, but it seems that in order to get approval you are required to open and maintain a business with employees in Europe. (Even if your actual operation is based in Canada or the USA). It's not something that I am able to authoritatively address in this post, and the varying interpretation in these rules between acquirers is somewhat unclear. The consensus seems to be that in order to qualify for domestic European processing you must have:

- A permanent office of some type

- Possibly employees

- Business decisions being made on the ground in Europe

- A portion or percentage of your customers must be located in Europe

These requirements are a significant roadblock to some businesses, because it requires a significant business presence that extends beyond just incorporating, for example, in the UK.

It seems to genuinely be looked at on a per-case basis by each processor. This is possibly due to the nature of some services being more virtual (digital downloads) and some physical (physical goods). There is complexity to it, and is a particular area that we try to help our clients with so if you have any questions about this reach out to us to discuss.

Understanding FX fees incurred upon settlement: often difficult to understand.

We have briefly discussed the cost benefit of like to like settlement, but haven't quantified the potential cost savings. We can begin with an obvious statement: when funds are converted from one currency into another there is a cost associated with it.

When you attach credit card processing to a currency exchange it's a somewhat complicated situation. Do you look at the exchange rate on the date the transaction was processed, or the date when funds are settled from the card issuer to the processor, or the day the funds are sent out to the merchant?

Also, what about currencies that have a lot of volatility? USD, CAD and USD are relatively stable currencies, but what about processing in more exotic currencies such as Russian Rubles or Indian Rupees? Currency volatility is another consideration.

Finally, even knowing these things, what rate does the processor look at when quoting a FX rate? Are they looking at a mid-market rate? Or are they looking at a cost set by another party such as an upstream processing platform, bank partner, or Visa or Mastercard? It's often hard to just get clarity as to how they derive the costs from which the calculations are driven. With all of these challenges, how can you properly drill into or control your costs? It's a confusing topic, even for me, and I've been in the industry for almost 20 years.

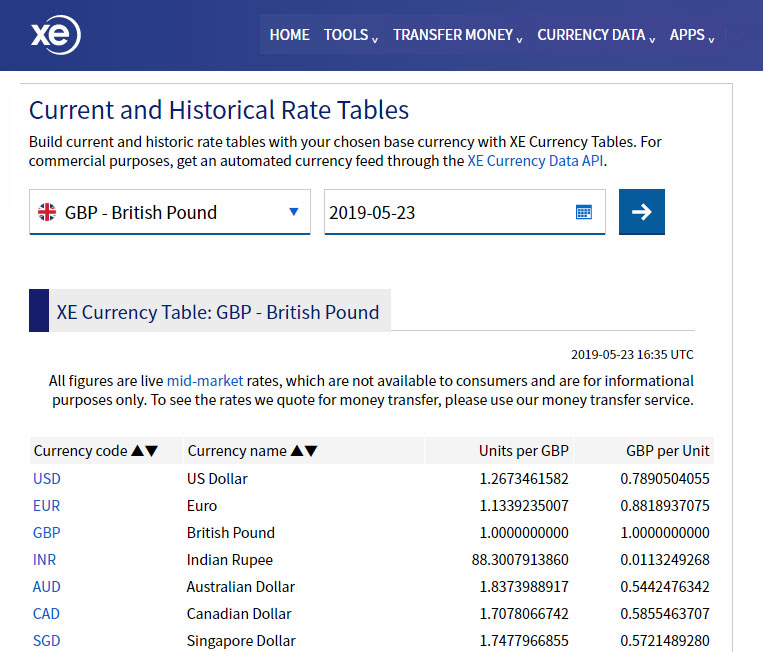

I've found the best approach is to ask for a historic chart of currency conversion rates from the payment processor. It should show you the historical exchange rates that were applied on certain days in the past. This way, you can see the FX rate that the payment processor applied, and compare it to historical mid-market rates on those days. This will help you build a point of reference, if not an exact scientific understanding, of the spread above mid-market and FX costs you'll likely be paying. You can do this comparison with a tool such as the historical FX rate tool provided by XE.com.

Souce: https://www.xe.com/currencytables/

Using a currency brokerage to reduce FX conversion costs

In order to realize the full cost benefit of like-to-like settlement, you have to put a good FX conversion solution into place. If you've not yet realized it, traditional banks do not give the best FX rates. Even if you have a good relationship, and even if you process conversions of $100,000 or more, you are still likely to pay a rate that is marked up significantly above the mid-market rate. That is because banks provide a wide range of financial services, whereas FX brokers only provide FX conversion services. In the same way that you could buy a set of tires for your car from any garage, but if you go specifically to a tire shop the price for tires will probably be more competitive.

- Average rate offered by a bank is often 2% to 3% above the mid-market rate

- Average rate offered by a FX broker is often less than 0.50% above the mid-market rate

- It makes sense to work with a FX broker if you convert currencies on a regular basis

- Learn more about mid-market FX rates here

Estimated cost savings utilizing like-to-like processing.

The hidden costs of selling internationally can be quite significant. The costs are very situationally specific depending on the location of your business, your customers and selected processing currencies. We'll review an example based on the following:

US business processing $1,000,000 per month in sales to foreign customers.

- Average discount rate of 2.5%

- Cross border fee of 0.80%. (discussed below)

- FX conversion fee of 3%

- Total cost per transaction: 6.3%

By establishing local acquiring the following savings could be realized:

- Average discount rate 0.75% (lower domestic interchange)

- Cross border fee is eliminated (0.80% to 0%)

- FX conversion fee is eliminated

-

Total cost per transaction: 0.75%

Total monthly cost: $7,500

Total monthly savings: $55,000

Total annual savings: $660,000

In the example above, this business could save $666,000 per year in processing costs. The reason for typing the example out, instead of just providing a figure, is it's so staggeringly large that it's almost unbelievable.

The example is purely fictional, but entirely, totally and completely possible. However, it's also very specific. If those customers were in South Africa, the interchange costs would have been very significantly different. The point is that you need to examine it for the merits of your particular business. The potential savings, at least in some cases, are truly and genuinely massive. This type of interchange consulting and optimization is what we do at Merchant-Accounts.ca, so if you do cross border sales, contact us to see if we can lower your processing costs.

Additional Cost Considerations - Cross border fees incurred by merchants

As described in cost savings example above, there is an additional cost consideration in the form of cross border fees. This cost is driven based on the region that your business is based in. Visa and Mastercard assess cross border fees any time a transaction crosses a border. For clarity, two things are looked at each time a transaction is processed:

- Where is the merchant located? This is not something that you will have control over, because it will be the country that your business is registered in. For example, a U.S based business will always be seen as a US domiciled merchant by Visa and Mastercard.

- Where is the cardholder located? More specifically, where is the bank that issued the card to the cardholder located. For example, a UK based cardholder whose credit card was issued by the Royal Bank of Scotland.

- A cross border fee is applied if the customers card was not issued in the same country that your business is located in.

How much do cross border fees cost?

The above explains if a cross border fee will apply, but not how much it will cost. The amount assessed depends on interchange in your region. Specifically, it will be charged to you based on the interchange cross border fees for merchants in your country, and also whether your charged the cardholder in their local currency. In the example above the merchant was based in the USA. The cross border fee that would be applied at the time of writing this article is 0.80%. It's possible the card brands may raise or lower cross border fees in the future.

The impact of currencies on cross border fees.

The payment currency will impact the cross border fee. In North America cross border fees work as follows:

-

Cross border fee not charged in cardholders local currency.

0.40% where a cross border transaction occurred but the cardholder was not billed in their local currency. (Which is out of scope of the discussion of this article - since we are specifically talking about billing foreign cardholders in their local currency). -

Cross border fee charged in cardholders local currency.

0.80% where a cross border transaction occurred and the cardholder was billed in their local currency. It is more expensive to bill cardholders in their local currency. Cross border fees are assessed by Visa and Mastercard. Your payment processor cannot control or stop a cross border fee from being assessed. (However, as we've spent a lot of time discussing, you can set your business up so that cross border fees do not apply).

Potential Customer Complaints: Be aware of international transaction fees to cardholders

In addition to cross border fees incurred by merchants, cardholders can also be charged cross border fees by their own card issuing banks. These are fees completely beyond the control of the merchant or the payment processor.

This is a point of frustration for merchants, because cardholders sometimes think these fees are initiated by the merchant or payment processor, but they are not. Adding to frustration is the fact that the cardholders credit card statement may make it appear as if the fees were charged by the merchant. This can sometimes lead to customer complaints.

It must be reiterated that whether or not international transaction fees are charged to cardholders is completely and entirely at the whim of each card issuing bank. For example, if you are a Canadian merchant and you establish a U.S currency merchant account, some customers may still be charged an international transaction fee, even if (as in this example) the transaction was processed in U.S dollars.

Fortunately, not all card issuers do this. If a card issuer does assess an international transaction fee it usually shows up as a separate line item below the purchase on the credit card statement, and is often 1%, 2% or 3% of the purchase price of the order. It will often still state the merchants name beside the international transaction fee, which is why cardholders sometimes think this fee is being charged by merchants. There are ways to combat complaints when this occurs. See how to address customer complaints.

Popular multi-currency capable shopping cart software

One question that all businesses must decide is whether to build their own platform or use off-the-shelf shopping cart software.

Building your own platform provides the most control and has obvious benefits, but there are as many drawbacks. (More work, more administrative requirements, etc).

If you are building your own shopping cart software you'll need to request the API from your selected processor. This will specify how to submit transactions from your website to the payment gateway. There are many different methods of integration, but they are all ultimately flavors of the same thing: the amount to be processed, the customer name, the billing address, card number, etc.

It's beyond the intended scope of this discussion to get into the specifics of building an e-commerce platform. However, the following are examples of shopping cart software platforms that are multi-currency capable:

It would be easy to get into a large discussion about shopping carts. However, the overarching and main advice I would caution here, is to select your shopping cart provider only after you've selected your payment processor. The reason for this is because your payment processor will drive all the significant payment processing related costs (interchange, discount rate, per transaction fees, settlement currencies, etc). The ideal way to set it up is to determine which processor will implement the best rate and processing feature structure for you, and then find a shopping cart platform that can integrate to your chosen processor.

You might have a shopping cart software that you have to use, and if so, that is fine. But ideally, you'll have flexibility, and can seek out guidance from your chosen processor to help you find a multi-currency shopping cart platform that is compatible with the payment gateway that will be used for your account. In an ideal scenario, this is almost always the best approach.

Popular multi-currency payment processors

Below you'll find an overview of some of the most popular multi-currency payment processors.

CashFlows

| Established Since | 2005 (21 years) |

| Processing currencies | CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF |

| Settlement currencies | CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF |

| Acquiring regions | UK and Europe |

Notes:

CashFlows is a fast moving and nimble acquirer based in London. They were the first non-bank full member acquirer in Europe, and exclusively support like-to-like settlement, making it an excellent fit for merchants looking to receive payments in foreign currencies. Cashflows exclusively supports European based merchants, and is usually a best fit for a mid-sized EU client with an international customer focus.

Merchant-Accounts.ca

| Established Since | 2001 (25 years) |

| Processing currencies | All major and most exotic processing currencies CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF |

| Settlement currencies | CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF |

| Acquiring regions | Canada, USA, UK and Europe |

Notes:

Merchant-Accounts.ca was Canada's first merchant account provider to specialize in multi-currency and cross border e-commerce payments. This article is written by David Goodale, CEO at Merchant-Accounts.ca.

Quote from Merchant-Accounts.ca:

Although we have a rich history of working with both small and large Canadian businesses, our customer base extends beyond the Canadian border. We work with merchants in countries around the world including the USA, England, Australia, Switzerland, Japan and Germany. At Merchant Accounts.ca we understand the global e-commerce marketplace. Although the payments industry has evolved tremendously over our 18 years in operation, our goal remains the same and our mission statement intact:

To continue providing the Canadian and international marketplace with the most inexpensive and easily established merchant accounts available, always with honest and transparent pricing, while maintaining the customer-centric focus that has helped each of our clients achieve the highest possible level of success.

Planet Payment

| Established Since | 1999 (27 years) |

| Processing currencies | All major and most exotic processing currencies CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF, etc. |

| Settlement currencies | CAD, USD |

| Acquiring regions | USA and Canada |

Notes:

Planet Payment is a long established processor based in Long Beach, New York. Planet Payment's expertise is in the field of base currency settlement. Few processors offer as many payment currencies as Planet Payment, and their multi-currency processing technology is licensed by other large processors. Planet Payment does not support like-to-like settlement options, so is a best choice when looking to process exotic currencies, or if looking to setup base currency settlement to keep your banking requirements simple.

Payvision

| Established Since | 2002 (24 years) |

| Processing currencies | All major and most exotic processing currencies. (80+ currencies) CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF |

| Settlement currencies | Determined by region |

| Acquiring regions | USA, Canada, Europe, Asia and the Pacific |

Notes:

Payvision has a large number of acquiring licenses and supported payment types. They support over 24 like-to-like settlement currencies which is among the most of any of the processing platforms on our list. Payvision also provides an alternative payments platform with support for many non-card payment types, including common local payment methods in EU, Asia, and LATAM. Their unique service feature is a consolidated reporting system, combining processing data from multiple MIDs, currencies, and payment methods into a single reporting engine for merchants. Payvision's multi-currency processing functionality consolidates transactions across multiple processing currencies into a single deposit bank account, with matching reporting to make reconciliation and accounting easier.

Expert Advice from Joe Emig, VP Business Development at Payvision:

WorldPay

| Established Since | 1998 (28 years) |

| Processing currencies | All major processing currencies, most exotic currencies. |

| Settlement currencies | CAD, USD, GBP, AUD, EUR, NZD, JPY, ZAR, DKK, ABC, DEF, GHI, KLM, NOP |

| Acquiring regions | UK, Europe, USA, Canada, Australia, AsiaPac |

Notes:

Ideal for both large and small businesses. Originally focused on UK merchants WorldPay has gone through a series of acquisitions and is now one of the largest global payment acquirers on earth. This scale has given WorldPay great depth of payments. It is often a better fit for large corporate merchants.

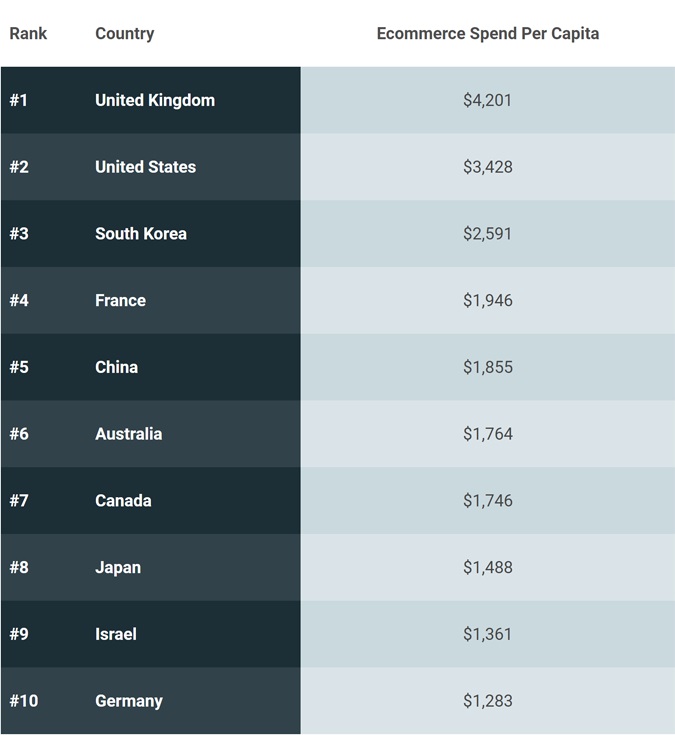

Most popular online payment currencies

USD is the world's most popular online billing currency. While USD is the most used billing currency in the world, Americans are not the biggest spenders per capita, which goes to the United Kingdom. The most active e-commerce payment currencies are USD, GBP, EUR, CNY, AUD, CAD, and JPY. Some countries, because of their geographic or cultural ties are strongly connected economically. As an example, it is common for both US and Canadian merchants to sell in both currencies.

Source: https://www.websitebuilderexpert.com

Multi-currency Research: Getting to know your prospective customers

An unlikely tool that can be used quite effectively to research foreign markets is the CIA world factbook. It provides facts on population, currency, economy, imports and many other facts that may come in helpful when working on your international payments strategy.

In terms of your international growth strategy, you may find strong support concentrated in a particular territory. A 2018 cross-border e-commerce survey from International Post Corporation found that 83% of all cross border e-commerce purchases originating from Canada were to US or Chinese e-commerce businesses. This is just one example but illustrates how important it is for US and Chinese e-commerce businesses to target Canadian customers (albeit I would hazard the guess that a lot of these transactions are fuelled by the two largest e-commerce platforms in the US and China).

You should keep track of your visitors and evaluate your marketing efforts using a tool like Google Analtyics to determine what percentage of your website visitors, or sales, come from different countries.

Source: http://ipc.be/shopper

Summary

Getting a multi-currency processing solution is relative easy. Setting it up in a strategically advantageous way requires knowledge of interchange in each country you are targeting, awareness of FX costs, cross border fees, and a technical implementation that will work smoothly for your customers. In addition, there may potentially be international taxation issues, depending on what steps you take to eliminate cross border fees and establish local acquiring in the different countries in which your business targets customers.

The benefits of like-to-like settlement are especially appealing if your business already has a presence in the EU, because you'll already be making tax filings in the EU, and will already meet the requirements of Visa and Mastercard. You shouldn't have to do anything extra in terms of setting up a business presence or preparing tax returns - you're already doing everything you need to do, and can just open the account and begin processing.

If you want a like-to-like settlement solution, but don't have a EU corporation it can strongly be worth the effort to establish one, especially if you trade high transaction volumes. If you need help with this then contact us because we can help you to navigate these waters.

On the flip side, base currency settlement is often the easiest approach and can greatly simplify many aspects of your e-commerce processing solution. It's often the more practical choice, especially for mid-sized and growing e-commerce businesses. In some cases, merchants may start with a base currency solution, and implement like-to-like settlement one currency at a time, as your marketing efforts in certain countries gain traction and more transactions are processed.

As you can probably see, multi-currency payments are a topic well worth a deep dive. With effort you can return a lot of reward to your business in terms of increased sales, reduces costs, and a competitive advantage over your competitors.

If you've made it this far, I hope you've found some of the advice useful. Multi-currency payments have been our core and sole focus at Merchant-Accounts.ca since 2001. If you would like some guidance I'd love to discuss your project. Don't be shy to reach out to the team, and ask for me directly if you want to discuss your project.

Need professional guidance?

Contact us for a free one hour consultation.

Can I Help Lower Your Processing Fees?

If you found this content helpful, will you give me the opportunity to quote on your business?

View Rates