January 06, 2023

David talks about the most important things for small businesses to keep in mind when setting up credit card processing. This includes staying away from long term contracts, avoiding cancellation fees, putting your best foot forward for approval, getting lower rates, having automatic rate reductions built into your agreement, and addressing technical concerns so everything works smoothly upon launch.

July 11, 2019

In the latest episode of our merchant education series we tackle the seemingly simple topic of costs. In addition to exploring the discount rate and interchange costs, we outline and provide some metrics for the actual rate you should be willing to pay for your business.

March 29, 2023

Why do some businesses get lower credit card processing costs than others? In this video David explores the criteria that cause some businesses to get lower rates than others and techniques that you can use to reduce your processing costs.

May 31, 2021

If you've ever been confused by the difference between a merchant account, a payment gateway and processor you are not alone. In this discussion we break down the role each of those elements play, and how they affect your overall processing costs.

March 29, 2023

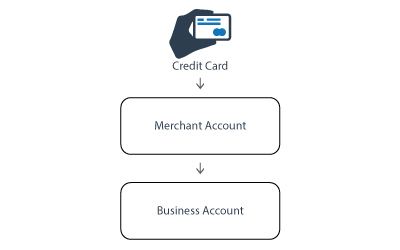

In order to accept credit card payments a business needs a merchant account. In this article we explain what a merchant account is, how to get one for your business, and the costs involved.

April 07, 2021

There is a lot of confusion when it comes to pricing in the payments industry. The most important cost of all is the discount rate. Learn what the discount rate is and why it's the most important and significant cost when processing credit card transactions.

July 07, 2023

Making the wrong choice can be costly when choosing a payment processor. David explores 3 of the most common mistakes so you can avoid them when choosing your credit card processor.

August 04, 2023

The debit system in Canada is called Interac. It's totally different from Visa or MasterCard so it works in its own unique way when it comes to making purchases online.

September 04, 2023

If you've not accepted credit cards previously you may wonder how long it takes to get your money. In this video David explores the most popular funding schedules for e-commerce and brick-and-mortar merchants.

June 07, 2024

How to pick a good credit card processor for your business. David gives advice so you can ask the right questions, avoid mistakes, and figure out which payment processors have the potential to be a good solution for your business.

June 17, 2024

When you work with a payment processor it becomes a long-term partnership. It requires a deep integration if you're doing e-commerce payments, and will have a long-term cost impact on your business. Outages are problems along the way can cause a major issue. In this video David explains when and how to look for references when searching for a payment processor for your business.

June 28, 2024

An original credit transaction is where a merchant sends money (gives money) to a cardholder. It's a unique service, but merchants should be very careful when using it.

September 23, 2024

MCC stands for Merchant Classification Category. Every type of business that accepts Visa or Mastercard has a MCC code associated with their business. David explains why the MCC code used for your business can impact the approval rate for your transactions (the wrong MCC code can result in more declined transactions), as well as the costs that you pay when opening your merchant account.

September 30, 2024

Certain types of businesses are more difficult to administrate from a payment processing perspective than others. In this video David explains what Visa HBR and Mastercard BRAM fees are, how much they cost, and why they apply to some businesses but not others.

March 13, 2025

Most credit card processors will ask for a copy of the most recent balance sheet and profit and loss statement when you apply to get a merchant account. David explains why payment processors care about company financials, how it can impact your application, and what you can do if the financials for your company are not as good as you'd like.

August 06, 2025

A BIN number, which stands for Bank Identification Number, is made up of the first 6 digits of a credit card number. These first few digits of the credit card contain information about the card such as which bank issued it, and the country it was issued from. David explains what you should know about credit card BIN numbers, and also how they can be an effective in spotting fraud.